The Public Service Loan Forgiveness (PSLF) program offers an excellent opportunity for employees working in public service roles to have their federal student loans forgiven after 120 qualifying monthly payments. To take advantage of this program, you must periodically submit an Employment Certification Form (ECF) to verify that your employment and loan payments qualify for forgiveness.

Completing the ECF can feel overwhelming, but with this step-by-step guide, you’ll be able to navigate the process smoothly and ensure your form is correctly filled out.

Step 1: Understand the Basics of the PSLF Employment Certification Form

Before diving into the form itself, it’s crucial to know that the Employment Certification Form is used to:

- Verify that your employer qualifies for PSLF using the PSLF Employer Search tool.

- Track your qualifying payments toward forgiveness.

- Ensure your employment is in public service for a qualifying organization.

Submitting this form annually (or whenever you change employers) is highly recommended, as it helps you stay on track for forgiveness.

Step 2: Gather the Necessary Information

To complete the ECF, you will need the following information:

- Your Federal Student Aid ID (FSA ID) or Social Security number (SSN).

- Your loan servicer’s contact details.

- Your employer’s legal name, address, and Employer Identification Number (EIN).

- Employment start and (if applicable) end dates.

Additionally, you will need to have the form signed by your employer. Make sure to reach out to your HR department or manager to coordinate that.

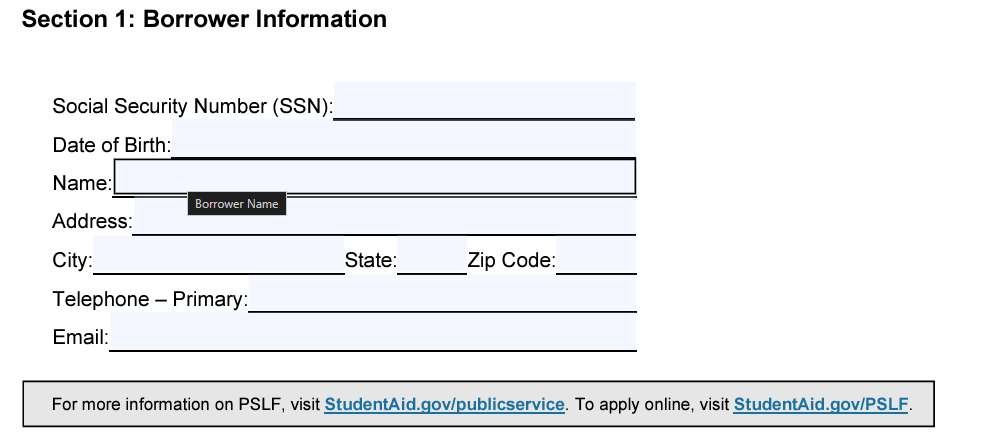

Step 3: Filling Out Section 1: Borrower Information

This section captures your personal information and acts as the identification section of the form. Here’s what you need to provide:

- Full Name: Write your first name, middle initial, and last name exactly as they appear in your loan records.

- Social Security Number: Enter your nine-digit SSN accurately.

- Date of Birth: Use the MM/DD/YYYY format.

- Address: Provide your current home address, including street name, apartment number (if applicable), city, state, and zip code.

- Telephone Number: List the best phone number for your loan servicer to contact you.

- Email Address: Enter a valid and active email address, ideally one you frequently check.

Double-check these details for accuracy to avoid any delays in processing.

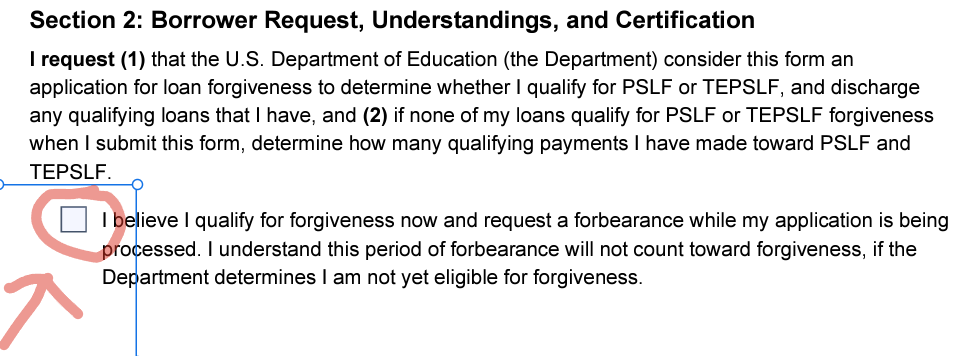

Step 4: Completing Section 2: Borrower Request, Understandings, and Certifications

If you believe you qualify for PSLF right now, you can check the box in Section 2 stating that you want to be placed in a forbearance until your application is processed, then sign and date on the form on Page 2 of 16. (see below)

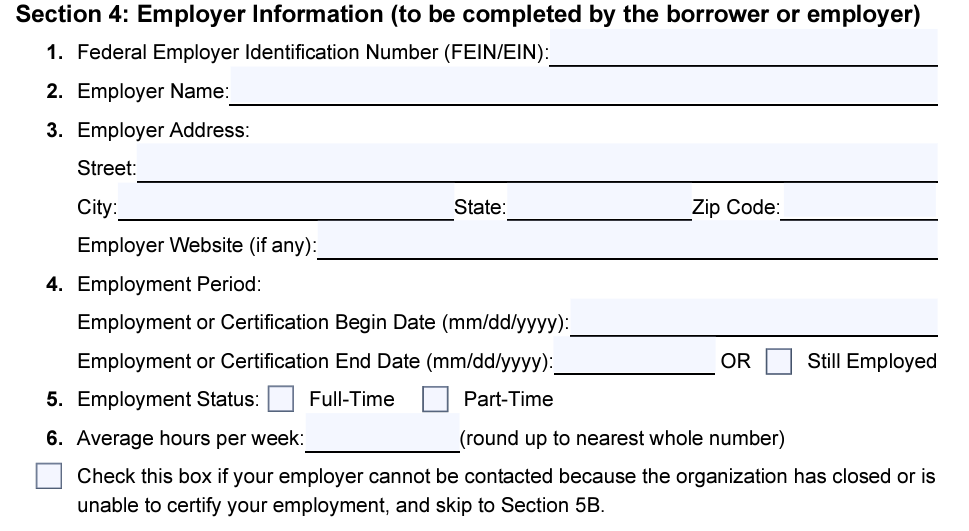

Step 5: Completing Section 4: Employer Information

Section 4 focuses on your employer’s details. To make sure your employer qualifies under PSLF guidelines, you’ll need to be working full-time for a government agency, nonprofit organization, or other qualifying employer. Gather the following information:

- Employer’s Federal Employer Identification Number (EIN): You can find this nine-digit number on your W-2 form or from your employer’s HR department.

- Employer Name: Provide your employer’s full legal name as it appears in official documentation.

- Employer’s Address: Include the street address, city, state, and zip code of your employer’s office.

- Employment Dates:

- Start Date: The date you began working for your employer.

- End Date (if applicable): If you are no longer employed by this organization, list the last day of employment. If you’re still employed, leave this field blank and check the box that you’re “Still Employed”.

- Employment Status: Check whether you are a Full-Time employee or Part-Time. To qualify for PSLF, you must work full-time, which is defined as working at least 30 hours per week or your employer’s definition of full-time employment, whichever is greater.

- Average Hours per Week: Provide the average number of hours worked per week (rounded up to the nearest whole number).

- If Your Employer is Closed: Check the box indicating that the business is closed and you cannot reach them. Skip to Section 5B.

Step 5: Understanding Section 5A: Employer Certification (must be completed by the employer!)

Section 3 must be completed by an official representative of your employer, typically someone in Human Resources or a supervisor with the authority to confirm your employment. This section verifies your employment details, which will be used to determine whether your employer qualifies for PSLF.

- Employer Representative’s Name: The name of the individual certifying your employment.

- Employer Representative’s Title: The title or role of the person completing this section (e.g., HR Manager).

- Employer Representative’s Phone Number: The phone number where this person can be reached for verification purposes.

- Employer Representative’s Email: The email address of the certifying official.

- Signature and Date: The employer representative must sign and date the form, certifying that the information provided is accurate.

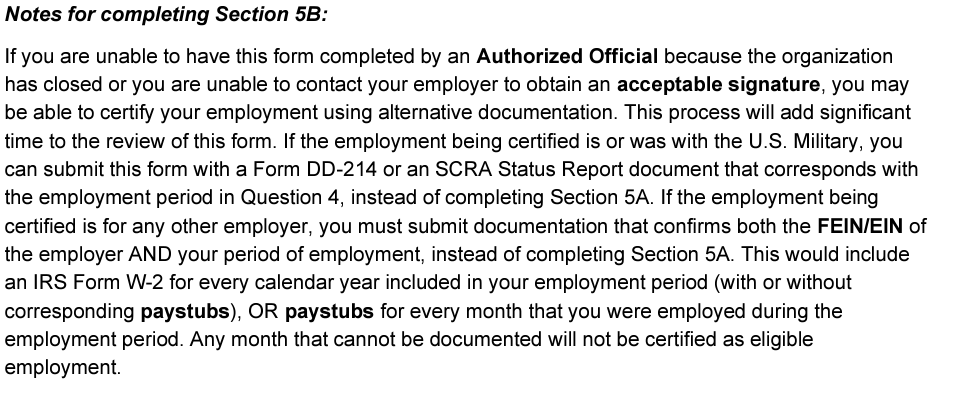

Step 6: Understanding Section 5B: Alternative Documentation For Employment Certification

Only complete this section if your employer is currently closed and you cannot contact them to sign off on the form. Alternative documentation includes a document that contain the FEIN/EIN of the employer and also the period in which you were employed. This includes a W2 and/or your paystubs for each month you were employer.

If you can’t document a month of employment somehow, you will not get credit.

Step 7: Submitting the Form

Once both you and your employer have completed and signed the form, you need to submit it to the Department of Education.

You can submit the ECF in one of the following ways:

- Online: Log in to StudentAid.gov and navigate to ‘My Activity’. You can then upload the form there.

- By mail: US Department of Education, P.O. Box 300010, Greenville, TX 75403

- By fax: (540)-212-2415

Be sure to keep a copy of the completed form for your records before submitting it.

Step 8: Keep Submitting Annually or After Employment Changes

To ensure continuous tracking of your progress toward loan forgiveness, submit an updated Employment Certification Form each year or when you change jobs. By doing so, you’ll prevent any surprises when it comes time to apply for forgiveness.

Final Thoughts

Completing the PSLF Employment Certification Form is an essential part of managing your student loan forgiveness process. By staying proactive and submitting the form regularly, you can ensure that your progress toward forgiveness is accurately tracked. The process can be lengthy, but with careful attention to detail, you can maximize your chances of successfully receiving PSLF.

If you have any questions about PSLF or need assistance completing the form, you can book a 60-minute consultation with StudentLoansGottaGo.com and we’d be happy to walk you through the form.